Based in Dallas, Texas, the Nacol Law Firm PC, traces its roots to the firm of Mark A. Nacol and Associates PC, established in 1979. The Nacol Law Firm team shares its experience on a variety of legal topics here. See our recent posts below.

Texas Divorce / Texas Child Support Questions and Answers

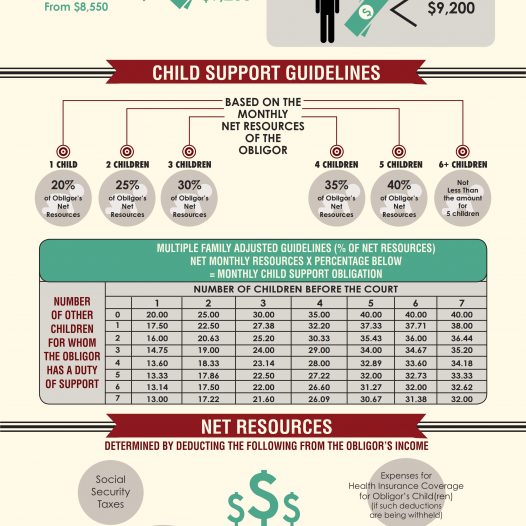

Q: How Much Is Texas Child Support ?

A: See our Infographic Above

Q: How long is the divorce process ?

A: In a Texas divorce there is a waiting period of a minimum of 60 days from the time you file the Original Petition commencing the lawsuit to the time the divorce may be finalized. Few divorces are finalized in this time-period. It is more likely that an uncontested divorce will take approximately 3 to 6 months and a contested divorce will likely will take much longer depending on the issues and conduct of the parties.

Q: Do my spouse and I both have to hire attorneys?

A: No. But it is certainly in your best interest to hire an attorney for a consultation purposes and to review legal documents for your own protection. An attorney should not in the vast majority of cases represent both parties, so if one attorney is involved he or she will under law be looking out for the best interest of the client that hired him/her, while the other party is representing themselves (pro se).

Q: Will I have to go to court?

A: If the spouses reach agreement, one party will have to appear in Court. Often times, when the parties have worked out their own settlement, that agreement is signed by each of you and submitted to the court with only one party making a personal appearance to state to the Court that the agreement has been reached and to establish statutory requirements. If, on the other hand, you and your spouse cannot come to an amicable settlement through this process, you will both have to appear in court, and often on many occasions.

Q: Should I Move Out of the Marital Residence?

A: Be sure to consult with an attorney before leaving the marital residence. Leaving the home may be viewed as abandonment or actually declaring a new residence, especially if you are taking personal items with you (clothing, automobile, sentimental possessions, etc.). If children are involved issues may arise as to who currently has or should have primary possession of the children. Once you have voluntarily left the home, it may be difficult to move back in or obtain orders for primary or temporary possession.

Q: How Do I Get a Divorce?

A: Before getting divorced you or you and your spouse should decide that you absolutely want and need the divorce. Even though in the divorce process prior to final judgment everything is reversible, it is important that you realize that the road is sometimes very long and can be a difficult one to travel.

Q: What if I Do Not Want a Divorce?

A: The advent of a divorce is something that slowly builds. You may want to consult with your spouse about placing things on hold while you receive counseling. However, the need for a divorce is rarely something that happens over night. Your spouse may have made his or her mind up long ago that divorce is the only option. If your spouse has filed for divorce, you have no choice. The most important thing for you to do if your spouse has filed for divorce is promptly seek proper legal advice.

If your spouse has significant assets and you feel they may be considering divorce seek legal advice immediately. You may want to do some pre-planning to make sure you have complete copies of original and final documents and know where all the marital assets are located and to assure their status. Do not give your spouse time to stash, spend away and/or hide assets.

Q: Can You Modify Child Support Orders?

A: Making changes to an existing child support order is not uncommon. Most states will not allow a request for modification on a child support order unless a time-period (of 2 to 4 years depending on the state) has passed since the order was put into place. Keep in mind that child support orders cannot be increased or decreased on a whim. In Texas, you must show a change in circumstances. However, if the person paying child support’s income has gone up or down more than 25% you can request a change. IMPORTANT NOTE: If you agree to no child support in your first order (Final Decree) and your spouse has a significant income at that time, you may have waived a statutory right to future child support unless the income level at the time of the existing order increases or decreases significantly.

Q: Can I Deny My Ex-spouse Visitation, Possession or Access?

A: You can not and should not deny visitation or possession, unless the Court has modified the visitation or possession to allow it! Denying visitation or possession is one of the biggest mistakes made by most primary custodial parents – it is an act of contempt in Texas. You may believe you have a justifiable reason for denying the visitation or possession rights, but by law your are not permitted to do so absent extraordinary circumstances, usually involving gross neglect or physical abuse.

Q: How Do I Get Custody of My Child(ren)?

A: The first and most important step to getting custody of your child(ren) is to be an involved and hands-on parent and to be honest. Being a great parent is not always the easiest task during divorce, but it is important to carefully consider each and every action you take during a divorce and how it may or may not effect the child(ren). You will also need good legal representation. Child custody issues can become ugly and complicated no matter how good your intentions may be. Make sure you are prepared. Document everything.

Q: What if I Do Not Like the Judges Decision?

A: The purpose of the ruling is to establish what exactly should be stated in the Final Divorce Decree. Once the attorneys have drafted the Final Divorce Decree and both parties have agreed that it coincides with the ruling, it will be presented to the Judge for signing. Once the parties have agreed and signatures are signed, you will have to live with the decisions. If the divorce is highly contested and the Judge rules and you are unhappy with the results, you have only a small window to appeal the decision or request a new trial.

Q: What is Fair Spousal Support or Alimony?

A: If you and your spouse can not come to agreement on the need for or amount of spousal support to be paid, the length of time, and under what conditions, the spousal support will most likely be set by a Judge according to Texas law.

Children in Distress: What to Do When You Need Emergency Relief

The right to obtain physical possession of a child, the right to obtain temporary relief without prior notice to the other party, and the right to exclude a party from a residence are all special circumstances in which emergency relief may be requested.

A writ of attachment is a court order requiring a child be produced at a particular location at a particular time. It is used in situations where a party is entitled to possession of a child under a court order. It may also be used when an emergency exists and a child is in imminent danger to his or her physical or emotional welfare.

The remedy is extraordinary. As such, specific facts must be alleged to command the court to issue the writ. The writ should be requested only when necessary to protect the welfare of the child.

Section 105.001 of the Texas Family Code provides the court may not render an order, except on a verified pleading or an affidavit which (1) attached the body of a child; (2) takes the child into the possession of the court or into the possession of a person designated by the court or (3) excludes a parent from possession of or access to a child.

Requests for writs of attachment are contained in petitions, motions and applications in suits affecting the parent child relationship and are filed ancillary to other requests. The court must then make a determination as to whether the necessity exists for the writ and the applications are in proper order.

The court issues a writ commanding any sheriff or constable to attach the body of a child and deliver the child to a designated place. That designated place is a location specified by the court who may command that the child be brought to the court or the court may provide a location where the child may be delivered by law enforcement.

Habeas corpus actions are brought when a party claiming a right to possession of a child is seeking the court’s help in getting the child physically turned over to that party. The court shall compel return of the child to the person filing the habeas corpus only if the court finds that the filer is entitled to possession under the order.

If the court fails to compel return of the child, the court may issue temporary orders if a suit affecting the parent child relationship is pending. The court may issues such temporary orders only if the suit affecting parent child relationship is pending and the temporary hearing is set at the same time as the habeas corpus hearing. The court may then enter an order if a serious immediate question concerning the welfare of the child is shown at the temporary hearing.

The court has defined “serious and immediate question” to mean imminent danger of physical or emotional harm that requires immediate action to protect the child. If a right to possession is established, the exception to granting the writ occurs when a serious and immediate question concerning the welfare of the child exists. If the writ is denied after the right to possession under a prior court order is established, the Texas Supreme Court requires the trial court issue a written temporary order containing a finding that there is a serious and immediate question concerning the child.

A serious and immediate question, although often alleged, is rarely found in habeas corpus actions.

A temporary order, when entered, should not be a final adjudication of custody. At a minimum, the temporary order should contain the filer’s temporary rights to possession and should set a further hearing.

Join our Network