Preventing Custodial Parent From Relocating Children Out of State

Mom and Dad are divorcing or have been divorced and are now sharing joint custody of their children in the same city in Texas. One parent receives a letter from the other parent’s attorney requesting that this parent be allowed to relocate the children to another state so he/she may take a better job position with another company! This is a dilemma no parent ever wants to experience! Child Custody cases involving interstate relocation jurisdiction issues cause much heartache and are costly legal battles.

What can a Parent do to protect themselves from children being relocated away from the non-moving parent to another state without her/his consent? How may this affect the parent’s relationship with the children?

The Texas Family Code 153.002 Best Interest of Child states “The best interest of the child shall always be the primary consideration of the court in determining the primary consideration of the court in determining the issues of conservatorship and possession of and access to the child.”

The Texas Family code does not elaborate on the specific requirement for modification in the residency-restriction context, and there are no specific statutes governing residency restrictions or their removal for purposes of relocation. Texas Courts have no statutory standards to apply to this context.

The Texas Legislature has provided Texas Family Code 153.001, a basic framework on their public policy for all suits affecting the parent-child relationship:

-

The public policy of this state is to:

-

Assure the children will have frequent and continuing contact with parents who have shown the ability to act in the best interest of the child;

-

Provide a safe, stable, and nonviolent environment for the child;

-

Encourage parents to share in the rights and duties of raising their child after the parents have separated or dissolved their marriage.

How does The State of Texas treat an initial Child Custody determination?

Texas Family Code 152.201 of the UCCJEA states, among other things, that a court may rule on custody issues if the Child:

*Has continually lived in that state for 6 months or longer and Texas was the home state of the child within six months before the commencement of the legal proceeding.

*Was living in the state before being wrongfully abducted elsewhere by a parent seeking custody in another state. One parent continues to live in Texas.

*Has an established relationship with people (family, relatives or teachers), ties, and attachments in the state

*Has been abandoned in an emergency: or is safe in the current state, but could be in danger of neglect or abuse in the home state

Relocation is a child custody situation which will turn on the individual facts of the specific case, so that each case is tried on its own merits.

Most child custody relocation cases tried in Texas follow a predictable course:

-

Allowing or not allowing the move.

-

Order of psychological evaluations or social studies of family members

-

Modification of custody and adjusting of child’s time spent with parents

-

Adjusting child support

-

Order of mediation to settle dispute

-

Allocating transportation costs

-

Order opposing parties to provide all information on child’s addresses and telephone #

Help to Prevent Your Child’s Relocation in a Texas Court by Preparing Your Case!

-

Does the intended relocation interfere with the visitation rights of the non- moving parent?

-

The effect on visitation and communication with the non-moving parent to maintain a full and continuous relationship with the child

-

How will this move affect extended family relationships living in the child’s current location?

-

Are there bad faith motives evident in the relocating parent?

-

Can the non-moving parent relocate to be close to the child? If not, what type of separation hardship would the child have?

-

The relocating parent’s desire to accommodate a new job, spouse, or other criteria above the parent-child relationship. A Parent’s personal desire for move rather than need to move?

-

Is there a significant degree of economic, emotional or education enhancement for the relocating parent and child in this move?

-

Any violation of an order or prior notice of the intended move or a temporary restraining order

-

Are Special Needs/ Talents accommodated for the child in this move?

-

Fear of child and high cost of travel expenses for non-moving parent or child to visit each other to be able to continue parent- child relationship.

-

What other Paramount Concerns would affect the child concerning the relocation from the non-moving parent?

At the Nacol Law Firm PC, we represent many parents trying to prevent their child from relocating to another city or state and having to experience “A Long Distance Parental Relationship” brought on by a better job or new life experience of the relocating parent! We work at persuading courts to apply the specific, narrow exceptions to these general rules in order to have child custody cases heard in the most convenient forum in which the most qualifying, honest evidence is available; cases where the child’s home state or other basic questions are clarified, and cases where a parent has the right in close proximity with their child regardless of other less important factors.

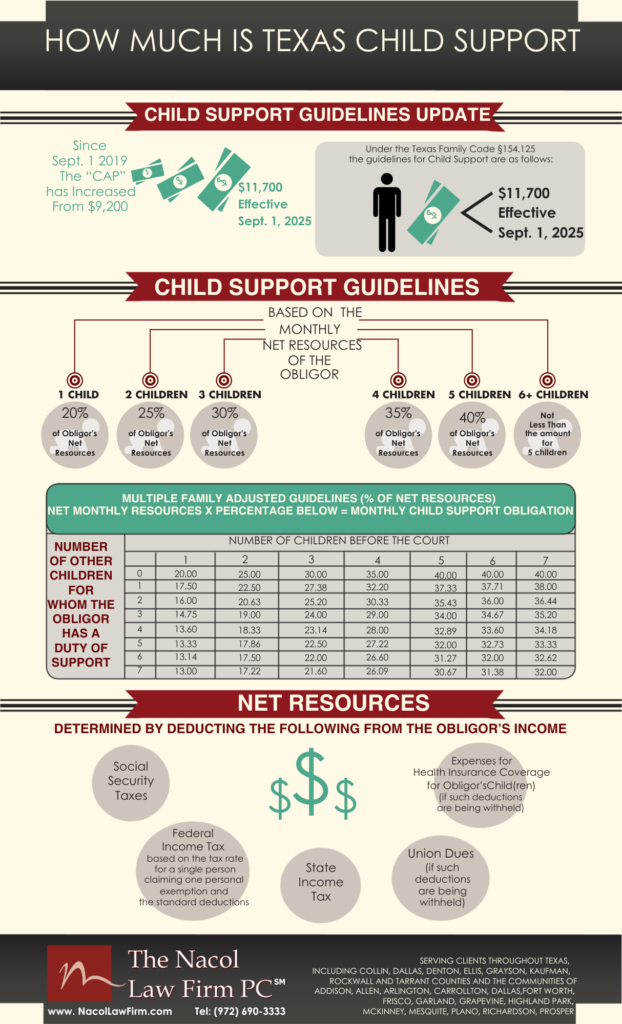

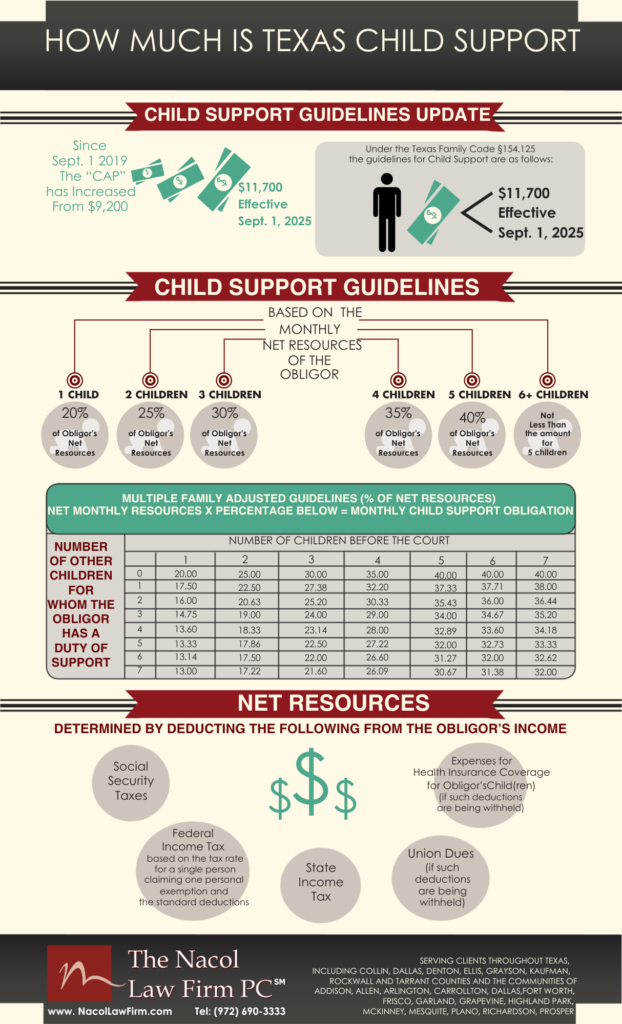

Texas Child Support Guidelines – How Much is TX Child Support?

UPDATE ON TEXAS CHILD SUPPORT:

A new cap is effective for all child support orders finalized on or after September 1, 2025

The Texas child support cap increased from $9,200 to $11,700 in net monthly resources for orders finalized on or after September 1, 2025, following legislative changes to the Family Code. This significant adjustment, part of the regular Texas child support guideline review, means higher guideline support amounts for higher-income parents. For example, the new cap results in a maximum monthly payment of $2,340 for one child (20% of $11,700) and up to $4,680 for five or more children (40% of $11,700) under the standard guideline framework.

Texas Family Code §154.125(a)(1) requires that every six years the presumptive amount of net resources to which the child support guidelines apply shall be reviewed and adjusted for inflation by the Texas Office of the Texas Attorney General (OAG). That section sets out the formula for doing so based on the consumer price index. The last adjustment was done in 2019 when an amount of $9200 per month was established.

How does the “cap” work and what could this mean for you? If your net monthly resources are less than $11,700, the child support obligation will not change on Sept. 1. You are under the “current cap” and lower than the “new cap”. All stays the same.

If you are currently going through litigation and your net monthly resources exceeds $11,700 and the Court orders child support prior to September 1, 2025, Texas Child Support Guidelines will mandate that the Court apply the appropriate child support percentage to the first $9,200 in net monthly resources based on the number of children. But, if the Court orders child support after September 1, 2025, it will apply the new appropriate child support percentage to the first $11,700 in net monthly resources.

Child support under the guidelines is determined by applying the applicable percentage, beginning at 20% for one child and increasing incrementally for each additional child, to the net resources amount. If a child support obligor has monthly net resources over $11,700, a party seeking above the guideline’s child support has the burden of proving to the court that additional support should be ordered according to factors set out in Texas Family Code §154.126.

Important to Know: The new “cap” increase of September 1, 2025 will not automatically increase the obligor’s existing child support obligation. Any change in child support standing before September 1, 2025, can only occur through the court with a modification order to increase the child support to the new “Cap” amount of $11,700. After September 1, 2025, any new suit for child support will be subject to the new “cap”.

Please review the Texas Office of the Texas Attorney General (OAG) website for a child support calculator for the new breakdown: https://csapps.oag.texas.gov/monthly-child-support-calculator

The Nacol Law Firm PC

8144 Walnut Hill Lane

Suite #1190

Dallas, Texas 75231

Nacollawfirm.com

Texas Divorce / Texas Child Support Questions and Answers

Q: How Much Is Texas Child Support ?

A: See our Infographic Below

Q: How long is the divorce process ?

A: In a Texas divorce there is a waiting period of a minimum of 60 days from the time you file the Original Petition commencing the lawsuit to the time the divorce may be finalized. Few divorces are finalized in this time-period. It is more likely that an uncontested divorce will take approximately 3 to 6 months and a contested divorce will likely will take much longer depending on the issues and conduct of the parties.

Q: Do my spouse and I both have to hire attorneys?

A: No. But it is certainly in your best interest to hire an attorney for a consultation purposes and to review legal documents for your own protection. An attorney should not in the vast majority of cases represent both parties, so if one attorney is involved he or she will under law be looking out for the best interest of the client that hired him/her, while the other party is representing themselves (pro se).

Q: Will I have to go to court?

A: If the spouses reach agreement, one party will have to appear in Court. Often times, when the parties have worked out their own settlement, that agreement is signed by each of you and submitted to the court with only one party making a personal appearance to state to the Court that the agreement has been reached and to establish statutory requirements. If, on the other hand, you and your spouse cannot come to an amicable settlement through this process, you will both have to appear in court, and often on many occasions.

Q: Should I Move Out of the Marital Residence?

A: Be sure to consult with an attorney before leaving the marital residence. Leaving the home may be viewed as abandonment or actually declaring a new residence, especially if you are taking personal items with you (clothing, automobile, sentimental possessions, etc.). If children are involved issues may arise as to who currently has or should have primary possession of the children. Once you have voluntarily left the home, it may be difficult to move back in or obtain orders for primary or temporary possession.

Q: How Do I Get a Divorce?

A: Before getting divorced you or you and your spouse should decide that you absolutely want and need the divorce. Even though in the divorce process prior to final judgment everything is reversible, it is important that you realize that the road is sometimes very long and can be a difficult one to travel.

Q: What if I Do Not Want a Divorce?

A: The advent of a divorce is something that slowly builds. You may want to consult with your spouse about placing things on hold while you receive counseling. However, the need for a divorce is rarely something that happens over night. Your spouse may have made his or her mind up long ago that divorce is the only option. If your spouse has filed for divorce, you have no choice. The most important thing for you to do if your spouse has filed for divorce is promptly seek proper legal advice.

If your spouse has significant assets and you feel they may be considering divorce seek legal advice immediately. You may want to do some pre-planning to make sure you have complete copies of original and final documents and know where all the marital assets are located and to assure their status. Do not give your spouse time to stash, spend away and/or hide assets.

Q: Can You Modify Child Support Orders?

A: Making changes to an existing child support order is not uncommon. Most states will not allow a request for modification on a child support order unless a time-period (of 2 to 4 years depending on the state) has passed since the order was put into place. Keep in mind that child support orders cannot be increased or decreased on a whim. In Texas, you must show a change in circumstances. However, if the person paying child support’s income has gone up or down more than 25% you can request a change. IMPORTANT NOTE: If you agree to no child support in your first order (Final Decree) and your spouse has a significant income at that time, you may have waived a statutory right to future child support unless the income level at the time of the existing order increases or decreases significantly.

Q: Can I Deny My Ex-spouse Visitation, Possession or Access?

A: You can not and should not deny visitation or possession, unless the Court has modified the visitation or possession to allow it! Denying visitation or possession is one of the biggest mistakes made by most primary custodial parents – it is an act of contempt in Texas. You may believe you have a justifiable reason for denying the visitation or possession rights, but by law your are not permitted to do so absent extraordinary circumstances, usually involving gross neglect or physical abuse.

Q: How Do I Get Custody of My Child(ren)?

A: The first and most important step to getting custody of your child(ren) is to be an involved and hands-on parent and to be honest. Being a great parent is not always the easiest task during divorce, but it is important to carefully consider each and every action you take during a divorce and how it may or may not effect the child(ren). You will also need good legal representation. Child custody issues can become ugly and complicated no matter how good your intentions may be. Make sure you are prepared. Document everything.

Q: What if I Do Not Like the Judges Decision?

A: The purpose of the ruling is to establish what exactly should be stated in the Final Divorce Decree. Once the attorneys have drafted the Final Divorce Decree and both parties have agreed that it coincides with the ruling, it will be presented to the Judge for signing. Once the parties have agreed and signatures are signed, you will have to live with the decisions. If the divorce is highly contested and the Judge rules and you are unhappy with the results, you have only a small window to appeal the decision or request a new trial.

Q: What is Fair Spousal Support or Alimony?

A: If you and your spouse can not come to agreement on the need for or amount of spousal support to be paid, the length of time, and under what conditions, the spousal support will most likely be set by a Judge according to Texas law.

Texas and Federal Confidentiality Laws: Use Caution with Your Texas Divorce

There are many legal and proper ways to obtain proof of a spouse’s infidelity. Take care to avoid tactics used to obtain private information that may violate federal and Texas confidentiality laws and a spouse’s right to privacy. You may be tempted by others to obtain proof of a partner’s infidelity by various inappropriate and/or illegal methods. Reading emails, recording telephone calls, installing spyware or geographical tracking devices or even setting up hidden cameras are just a few methods a spouse may be offered when entertaining the thought of catching a cheating spouse. However, such actions may expose both parties and their attorney to civil liability and possible criminal penalties. Under Texas law, it is a crime to install a geographical tracking device on a vehicle owned by another person. When emotions are running high, it is imperative that you seek proper counsel as to the proper legal action to be taken when establishing facts.

Both federal and state wiretapping laws apply to divorcing spouses. A spouse may sue the other spouse or their agents for invasion of privacy. Federal law regulates electronic surveillance of conversations and access to emails, faxes and voicemail. The law imposes civil and criminal sanctions for intentional interceptions of electronic communications. However, accessing email after it has been transmitted, i.e. downloading a text from your telephone or email from the hard drive of a family computer, is not an offense under the Federal Act. Texas has laws that also prohibit the interception of communications. Under such laws, counsel may also be held liable if they disclose information received from the intercepted communications provided by their clients.

Federal and Texas laws both allow recording of telephone calls and other electronic communications with the consent of at least one party to the communication. Under the one-party consent statutes, a spouse may record conversations in which he or she is participating. This has been extended to include parental recording of a child’s conversations with a third party, including the other parent. The parent can consent to the recording on behalf of the child so long as the parent has a good faith objective and a reasonable belief that it is in the best interest of the child, even if the child is unaware of the recording.

It is important that a spouse take great care in their means and methods of gathering information. Information obtained by illegal means can expose one, even if he or she is a spouse, to civil liabilities and possible criminal prosecution. Texas recognizes that every person has a certain right to privacy. Such right is violated if a person intentionally intrudes upon the private affairs of another by offensive means. Accessing stored email or secretly recording a spouse can be a violation of a spouse’s right to privacy. If a suit is filed, the damaged spouse may recover monetary damages, including punitive damages.

For answers to your questions on gathering information for your Texas Divorce, contact Dallas Divorce attorney Mark Nacol with the Nacol Law Firm, P.C.

Family Conflicts and the High Conflict Spouse

Divorce Courts are full of “High Conflict People” (HCP’s).

HCP’s seem very caring and sincere and it may take months or years before a legal professional can identify this personality disorder. HCPs may cause enormous emotional pain and excessive financial costs to their spouse and children before this disorder is brought to light.

Bill Eddy, legal specialist of the High Conflict Institute, has given a list of

The High Conflict Personality Pattern of HCP Personalities

- Rigid and uncompromising, repeating failed strategies

- Unable to heal or accept a loss

- Negative emotions dominate their thinking

- Won’t reflect on their own behavior

- Can’t empathize with others

- Preoccupied with blaming others

- Won’t accept any responsibility for problems or solutions

HCP’s stay unproductively connected to people through conflict and will continue to create conflict to maintain any sort of relationship, good or bad. Since HCP’s undermine all relationships, they constantly repeat their same patterns and usually end up divorcing repeated times. 20-30% of all couples getting divorces have at least one HCP spouse.

According to the High Conflict Institute, HCPS are driven by four primary fees:

- Fear of being ignored

- Fear of being belittled or publicity exposure

- Fear of being abandoned

- Fear of being dominated, includes fear of losing control over you, the other spouse, their money/assets, or themselves

What can the spouse of an HCP do to help bring the family conflict or divorce to completion?

- Tell your attorney what your bottom line is and stay with your decision.

- Maximize any leverage you have and stay on the course.

- Choose your battles carefully.

- Everything must be in writing.

- Work on keeping total & consistent emotional detachment from the HCP.

Just remember the HCP feels that since you are no longer together, and since you know too much about him/her, you must be discredited so that no one will think that they are the problem!

You will need to learn some practical skills on communication and response to your HCP and also when & how to let your attorney deal with this situation, how to enforce your guidelines, and hopefully, your thoughtful and reserved conduct will result in the best possible outcome.

NACOL LAW FIRM P.C.

8144 Walnut Hill Lane

Suite 1190

Dallas, Texas 75231

972-690-3333

Office Hours

Monday – Thursday, 8am – 5pm

Friday, 8:30am – 5pm

OUR BLOGS

SEARCH

JOIN OUR NETWORK

Attorney Mark A. Nacol is board certified in Civil Trial Law by the Texas Board of Legal Specialization